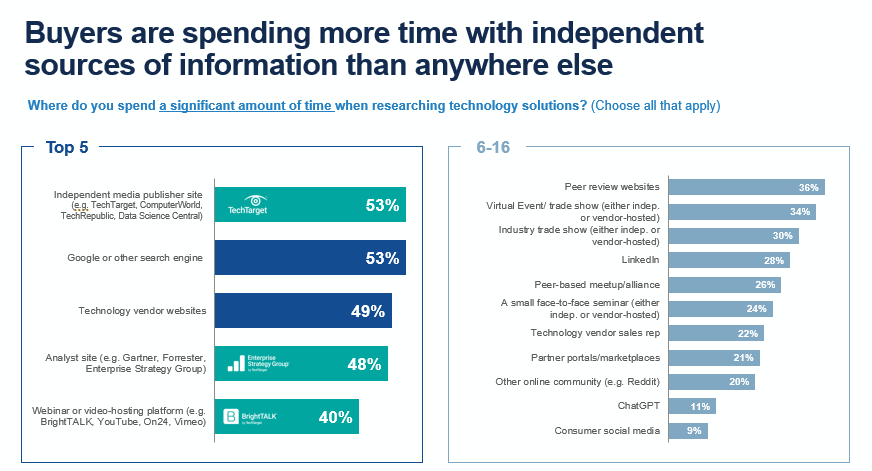

Technology buyers in our 2024 Media Consumption Study have shared their insights: they are increasingly turning to independent information sources for researching marketing solutions. But what other sources, aside from independent sites, rank high on the list of most engaged research resources for purchasing decisions?

Here, we highlight the top sources where buyers are dedicating their time. These five sources should be prioritized in your distribution plan, as they are key places where potential buyers are likely to gather. We will also examine the types of content buyers depend on during their research process to inform your content strategy.

Independent content sources are essential to your marketing strategy.

Over half (53%) of participants reported spending a significant amount of their research time on independent media publisher sites (such as ComputerWorld, TechRepublic, and Data Science Central). To enhance your investment in independent and analyst content and align more closely with buyers’ media consumption habits, consider commissioning a third-party expert to assess or review your solutions. Readers tend to trust third-party, independent content sources more than any other type, providing deeper insights for buyers looking to understand the ROI of your solutions from an external perspective.

Another important category is analyst sites: 48% of buyers indicated they seek out sites like Forrester Research and Gartner during their research phase. Additionally, platforms like Google, vendor websites, and webinar or video-hosting services like BrightTALK and YouTube complete the list of the top five media sources where buyers spend most of their time, reinforcing that these channels are among their most trusted information sources.

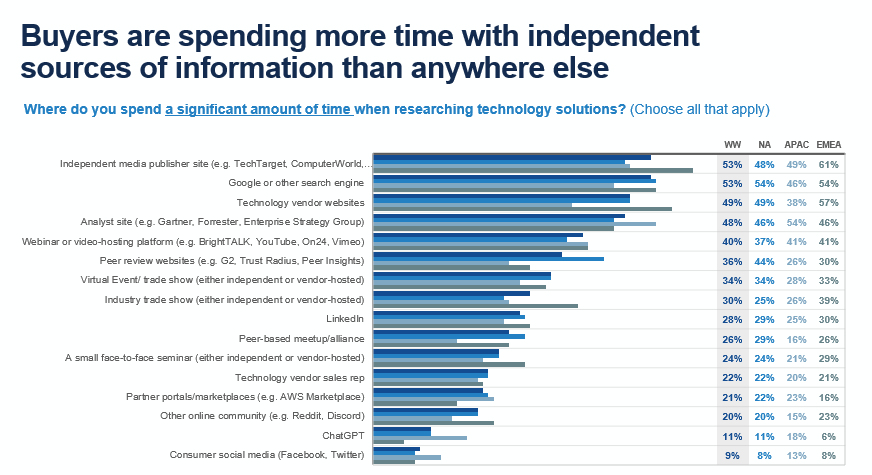

How do these research preferences vary by region?

In the U.S., buyers spend more time on peer review sites compared to those in APAC and EMEA, and they prioritize search engines like Google for their research. For tech buyers in APAC, analyst sources are their primary research destinations, while EMEA responses suggest that buyers in this region have more extensive research needs than those in North America and APAC. For teams aiming to reach a global audience, it’s crucial to leverage a variety of independent sources to connect with all in-market buyers and not overlook specific regional preferences.

Transform Trusted Research Sources into Shortlist-Worthy Content

In addition to the overall categories discussed earlier, we asked participants in our Media Consumption Study, “Which media types help you build vendor shortlists as a buyer?” The top four types of content identified were:

- Independent Expert Technical Advice and Reviews: As previously mentioned, buyers are drawn to independent technical advice, analyst reports, and expert vendor reviews during their purchasing journey. It’s essential to invest in and promote this content to capture buyers’ attention.

- Case Studies: These showcase real-world product use cases and highlight tangible results from customer success stories. They provide proof of expected ROI and demonstrate how your solutions perform in actual environments.

- Webinars (Tied): Forty percent of buyers engage with webinars or video-hosting platforms to gather tech buying information. Developing webinar and multimedia content is crucial for diversifying your content strategy and engaging potential buyers through both streaming and downloadable formats.

- White Papers (Tied): Educational white papers are highly effective for email and nurturing outreach due to their wide appeal across the buying cycle. They support buyers in the awareness, consideration, and decision-making stages, making them a powerful tool for any marketing campaign.

In conclusion, meet your buyers where they are by incorporating these content types into your strategy to enhance engagement with your brand.